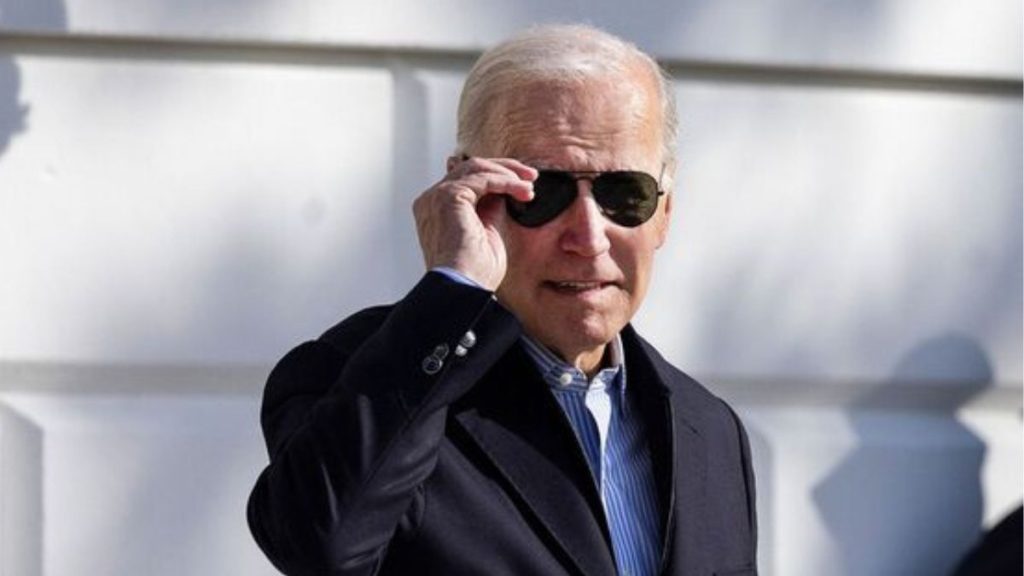

In today’s ever-changing higher education landscape, the cost of obtaining a degree can be extremely high, leaving many graduates with the enormous burden of paying back their student loans. The Biden administration has implemented several loan forgiveness biden programmes to help with this problem and increase college participation.

Learn everything there is to know about the various Biden loan forgiveness programmes, including how to apply, what you’ll need to qualify, and what to do next to get out from under

Loan Forgiveness Biden: Unveiling the Options

Exploring Public Service Loan Forgiveness (PSLF)

For those who have dedicated themselves to serving the public, Public Service Loan Forgiveness (PSLF) can be a ray of light. Government and nonprofit employees who make 120 qualifying payments will have their remaining loan balance forgiven. The possibility of loan cancellation plus rewarding public service = win-win.

Targeted Assistance through Teacher Loan Forgiveness

The Teacher Loan Forgiveness programme recognizes the importance of teachers in shaping the future. Educators who have worked in low-income classrooms or for nonprofits that support education for at least five years are eligible for loan forgiveness of up to $17,500. The goal of this programme is to keep qualified teachers in high-poverty classrooms.

Income-based repayment plans are a lifeline for those who are struggling financially. A borrower’s monthly payments may not exceed a certain percentage of their discretionary income under plans such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). A borrower’s loan balance may be forgiven after 20 to 25 years of on-time payments, providing a path to financial freedom.

Breaking Down Borrower Defense to Repayment

Borrower Defence to Repayment is available to borrowers who believe they were the victims of fraud or deceptive practices by their schools. The loans associated with those fraudulent experiences can be forgiven through this channel. The recent expansion of this program shows the administration is serious about protecting students‘ rights.

The Rise of Closed School Discharge

Closed School Discharge applies when a school is closed either while a student is enrolled or soon after they have withdrawn. This program cancels federal loan payments in light of the unexpected difficulties students face when their schools close. For those in educational purgatory, it’s a much-needed lifeline.

Loan Forgiveness Biden: Making it Happen Navigating the path to loan forgiveness Biden initiatives involves a series of strategic steps:

Gather Documentation: Compile loan records, employment history, and other essential documents.

Research Eligibility Criteria: Understand the requirements for each forgiveness program to determine which aligns with your situation.

Evaluate Repayment Plans: Consider income-driven repayment plans that suit your financial standing.

Complete Necessary Forms: Accurate and timely completion of application forms is crucial.

Submit and Monitor: Submit applications and stay informed about their progress.

Stay Informed: Keep abreast of policy changes and updates to make informed decisions.

Conclusion

The Loan Forgiveness Biden programs are a ray of light for people who are drowning in student loan debt. Borrowers can pave the way to a debt-free future by learning the ins and outs of each program, keeping their paperwork in order, and applying with due diligence. The administration’s dedication to making higher education more affordable and accessible is highlighted by these measures.

FAQs: Loan Forgiveness Biden

Q: Are private student loans eligible for loan forgiveness under these programs?

A: No, the loan forgiveness initiatives primarily apply to federal student loans.

Q: How do I prove qualifying employment for PSLF?

A: You can submit an Employment Certification Form annually or whenever you change employers to track your progress.

Q: Can I apply for multiple loan forgiveness programs simultaneously?

A: Yes, you can apply for different programs if you meet their respective eligibility criteria.

Q: Will loan forgiveness impact my credit score?

A: Generally, loan forgiveness doesn’t directly affect your credit score. However, it’s important to monitor your credit report for accuracy.

Q: Is there a deadline for applying to these programs?

A: While some programs don’t have strict deadlines, it’s advisable to apply as early as possible to maximize your benefits.

Q: Can international students benefit from loan forgiveness?

A: Loan forgiveness programs are typically available to U.S. citizens, permanent residents, and eligible non-citizens.